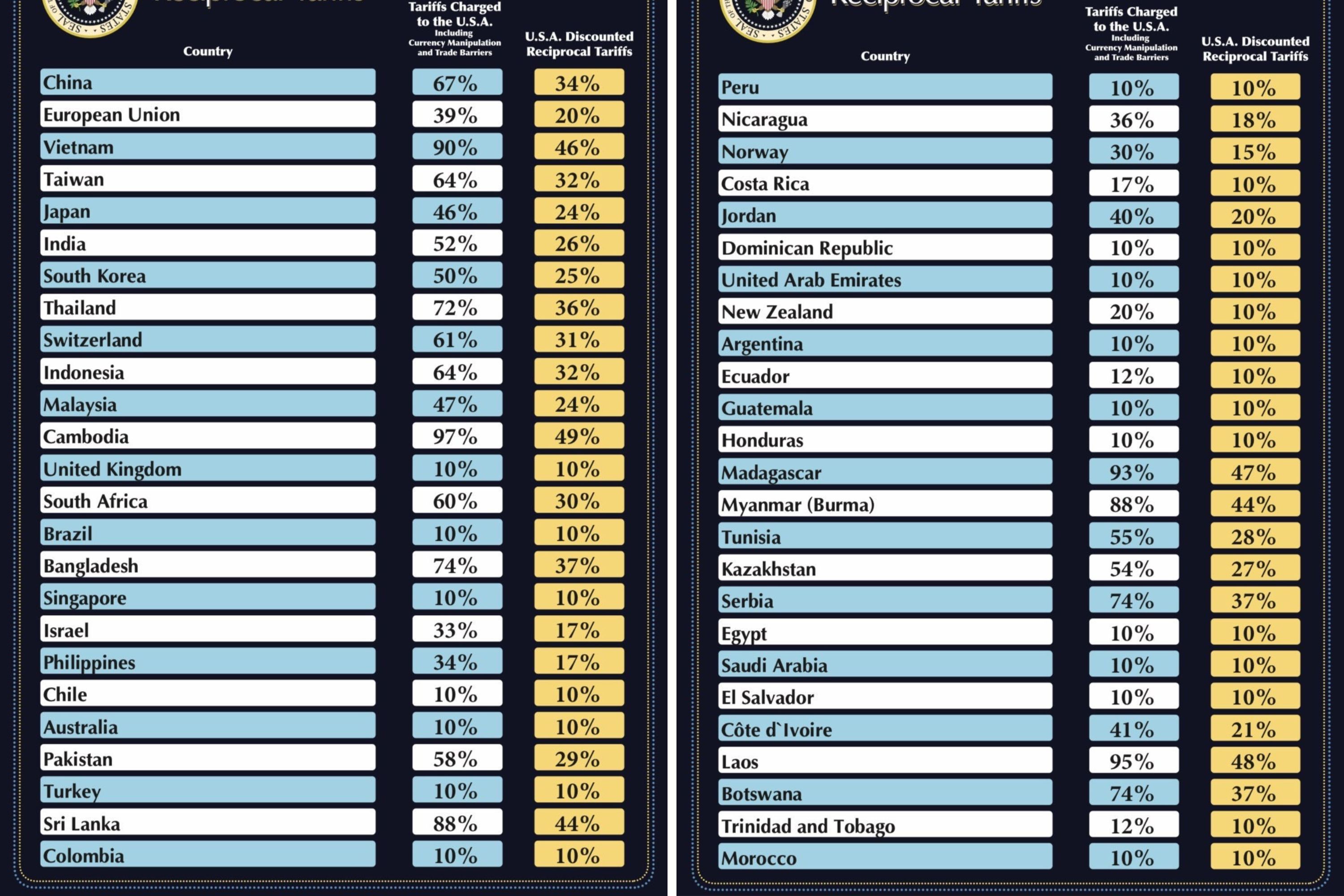

The 10% tariff on the DR will begin at 12:01 AM April 5th.

With few exceptions the DR will be affected. The biggest exception for the DR is gold.

Products manufactured in the free trade zones and exported to the US will be tariffed 10%.

The issues with the DR and they are small compared to the the other larger trading partners of the US, are rice and autos. The DR imposes heavy quotas/tariffs on US rice imports, despite DR/CAFTA having sunset them. Additionally, and from personal experience, the DR has not abided by DR/CAFTA in that US made vehicles would enter the DR essentially under a reduced tax regimen compared to vehicles manufactured in other countries.

Finally, unless something changes, on May 5th, 2025 small value goods from China will also be taxed. Think of the small items people purchase and send to a P.O. Box in the US and then send via courier to the DR.

The worldwide implications on people and goods are huge and I suspect the phone lines at the WH are lighting up from countries looking for exemptions or as is the case of Vietnam looking to rethink their tax/tariff regimen.

Agree or disagree, the fact is the US is merely asking for fair trade and an even tax/tariff playing field, something that has been missing for decades.

Respectfully,

Playacaribe2